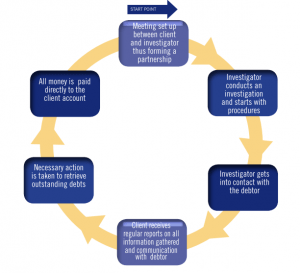

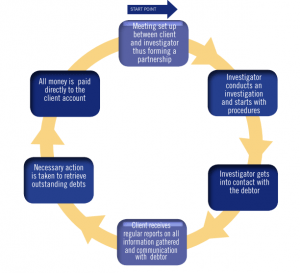

As far as commercial dent is concerned, experts from every debt collection agency have a same thought in mind that to get this debt back, it is very important to have sound debt collection strategies and procedures. There are several of them, but there is another thing to know, i.e. how and when and which strategy to apply so that that collection process could get simplified, fast and result-oriented. Here in this post, we will have a look at some strategies or steps that people could take for successful debt collection.

There are various Corporate Collection Processes that can include –

- Personal contact with your client either face to face or via the telephone

- Written demand requesting payment

- Negotiation

Let us go through them one by one here.

Personal Contact

- Experts from debt collection Sydney agencies say that it is very important that personal contact is maintained with the debtor as this is going to be very helpful in the debt collection process.

- In this regards, another important tip is that early connection is very helpful as this will address the issues arising related to the debt payment or non-payment.

- Depending upon the size of the debt and relationship with your client you may choose to arrange a meeting to discuss the debt.

Written Demand

- Another very useful method is “Written Demand” that is a kind of notice to be sent to the debtor right after the due date if crossed and in fact before that too, as a gentle reminder.

- This written notice would simply include the details of the debt, indicate the date payment is expected and advise to the debtor that the payment should be made by the date.

Negotiation

- If the debtor shows hi inability today the debt, in that case, this strategy can be implemented and experts say that this actually works really well as far as debt collection Sydney is concerned.

- Experts too say that it is always beneficial to negotiate a satisfactory amount or arrangement that will see payment of the debt without further action.